The recent increase in the number of overcoats and puffer jackets at open houses has confirmed the transition from an active Autumn to Winter market conditions across Victoria.

As we turn our attention to what we can expect from the season ahead, it’s important for our readers to understand that we are currently in a market that is defined by “consistent inconsistencies”. That may seem like an odd thing to say, but we are finding that the environment for property sellers can not only be quite different from one postcode to the next, but also from one property category to the next. Hence, getting experienced and objective advice is crucial before you make any firm property decisions right now.

From an overall perspective, I can confirm that stock levels reached their peak in the pre-Easter period but have remained seasonally high since then with auction numbers regularly reaching 1200 during May. As a result of these increased volumes, clearance rates have slipped from the high 60’s to the high 50’s.

Having said that, we are finding that in the majority of Melbourne’s suburbs, family homes and entry level properties are achieving generally pleasing results. Interestingly, we are even seeing a good percentage of the former rental stock that has been hitting the market also selling successfully, with first home buyers and investors preferring these options rather than the uncertainty surrounding many of their ‘off-the-plan’ competition.

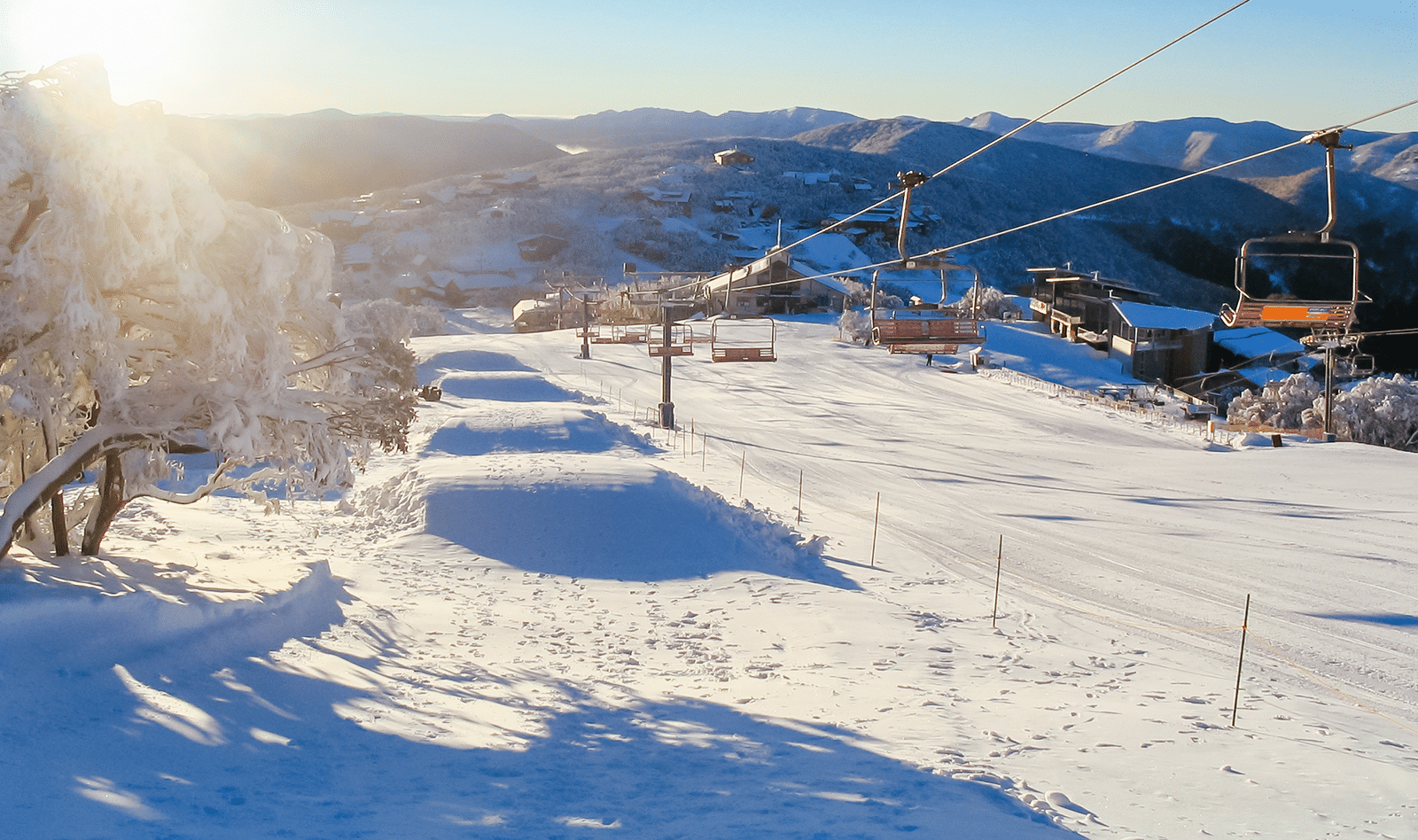

The segments that are finding it tougher right now include some of what might be described as “lifestyle properties” in the regional and coastal markets. Clearly the increased tax burden on second dwellings and holiday homes is having an impact.

The one factor that is evident across every demographic right now is the importance of getting your pricing right from day one. Buyers are tending to respond positively to new listings that reflect a realistic approach from the sellers, with competition still producing outstanding results in some cases. In contrast, any new listing with a price that exceeds reality by even a small margin tends to get stale very quickly without necessary adjustments.

Looking ahead, the combination of falling stock levels and consistently solid buyer demand means that the Winter of 2024 looks like being a positive period for most sellers. This is particularly the case given that we are talking to a lot of property owners right now who are making plans for a Spring sale, leaving the door open for those vendors who are able to make a move while competition from other vendors is reduced.

Before I close, I should also remind our many investor clients that the end of the financial year is rapidly approaching, so don’t leave it too late to touch base with your taxation advisor in case there are actions you should take prior to June 30th.

Remember, if you would like to discuss your property options in order to set a clear plan in place, whether you are buying, selling or both, then don’t hesitate to give us a call at Ian Reid Buyer and Vendor Advocates on 9430 0000.

Best wishes,

Ben Reid